Content

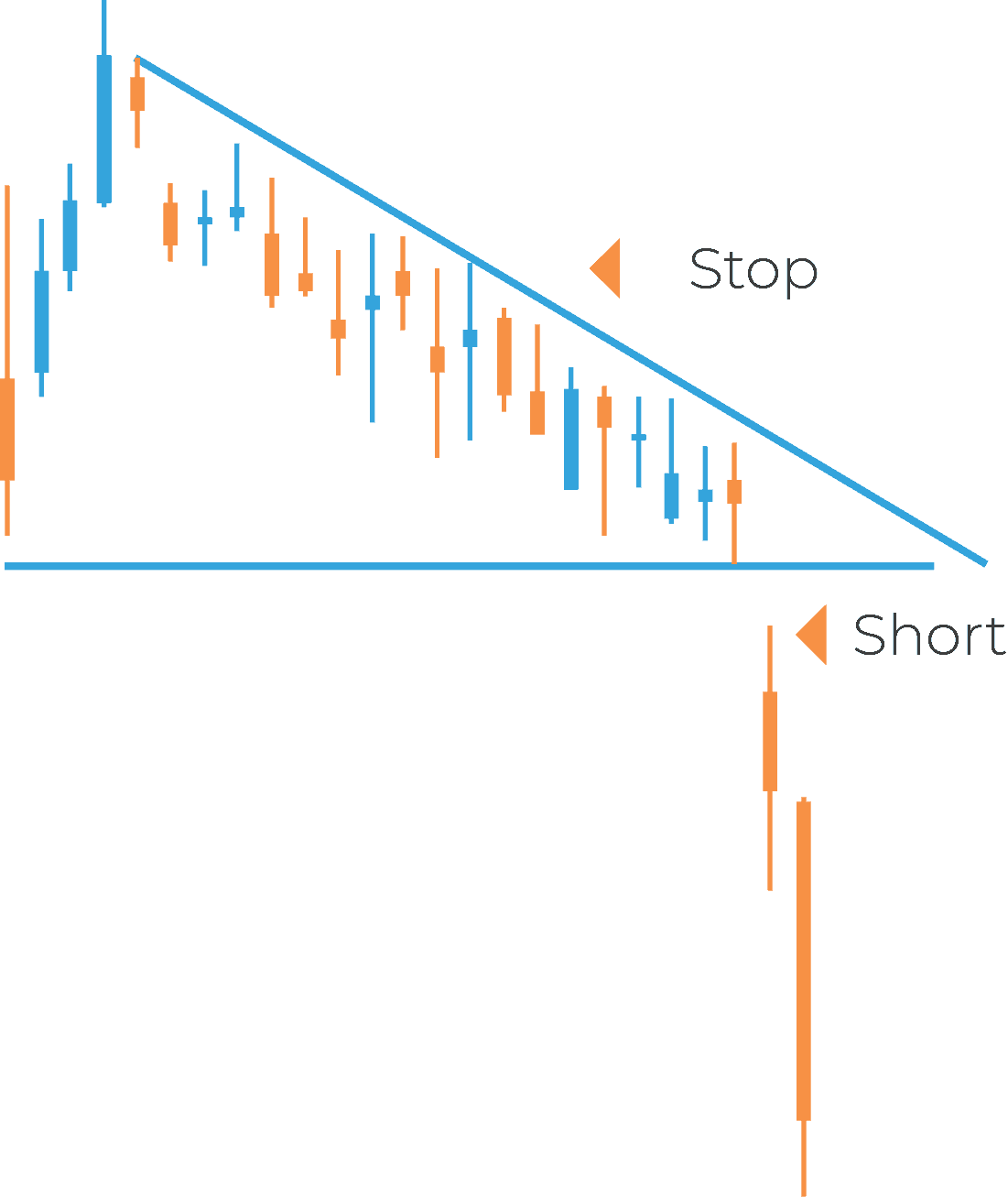

This information tells traders that it’s time to modify their stance by adding extra stop-losses or short selling to avoid losing capital. There are many bullish candlestick patterns that indicate an opportunity to buy, but there are several bullish stock patterns that give a stronger reversal signal. Bearish candlestick patterns on a chart visually show selling pressure.

- We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading.

- The candles appear similar to Spinning Tops, in that they show the bulls and bears are engaged in heavy battle, with neither side able to gain the decisive edge over the other.

- This cheat sheet will help you better time your entries when the market sentiment is bullish.

- You only need a handful of your favorites that you can master to make profitable trades.

- The Piercing Line can look very similar to a Bullish Engulfing pattern.

The volume signature will likely appear elevated as supply is being absorbed, keeping the candles small in the presence of selling pressure. In this case, the Bearish Engulfing Crack is consumed by two bullish candles that resolve to the upside. If you are short, hopefully you have respected your stop loss. Ideally, you identify the hammer candle, take a position long on the break to the upside of the candle, and set a risk in the body of the Hammer, or at the lows. They are very useful in finding reversals and continuation patterns on charts. While we discuss them in detail in other posts, in this post we…

What is a candlestick pattern?

This shows that both the bulls and the bears had periods of control during the session, but in the end, neither was in control. This pattern will typically form after a move, or trend higher has taken place. The key with this pattern is that we need to see it formed after a move or trend higher. The black Marubozu pattern is the bearish opposite of the white Marubozu pattern.

Very similar to the above example of the Bullish Engulfing Crack, this pattern simply takes a bit longer to “get going,” so-to-speak. You go long at the break of the prior bar and set a stop at the lows. Imagine the surprise if you are a short seller when a stock appears to confirm your downward thesis, only to completely reverse on you. We are looking to capitalize on shorts who are taking their profits and covering, along with dip buyers who are taking a chance here on the oversold conditions.

Candlestick patterns are separated into bullish and bearish patterns. They signify periods where the bulls and bears could not drive the market in a particular direction. In the next section, we will discuss the different types of candlesticks. Traders should always wait to confirm reversal by the subsequent price action before initiating a trade.

Reliable Bullish Candlestick Pattern

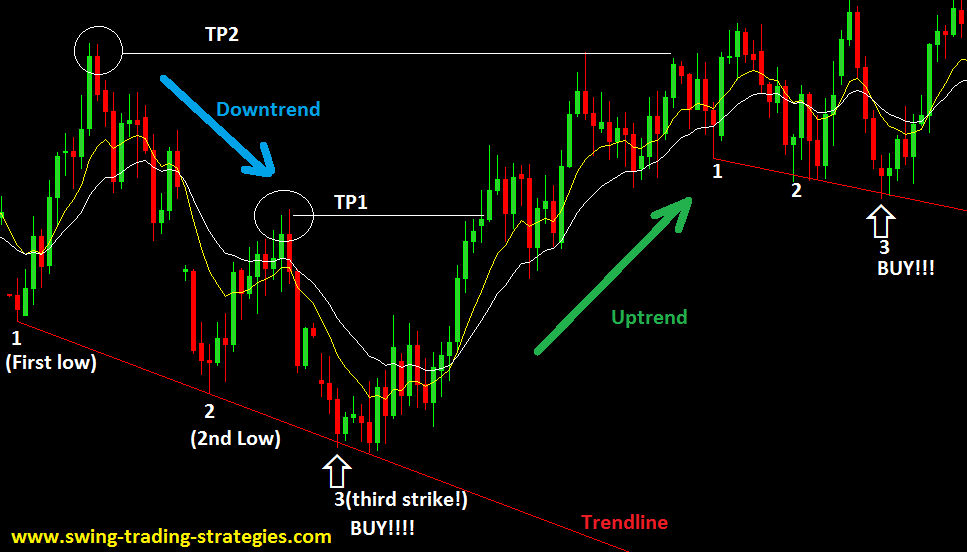

Much like the Three White Soldiers and Three Black Crows, the Three Inside Up/Down is a rare reversal pattern you’ll usually find forming at the end of trends. The pattern consists of three bullish candles, all which form different sizes. Tweezer Tops and Bottoms are one of the most common two-candle patterns you’ll see form in the Forex market.

- The Harami candlestick pattern is usually considered more of a secondary candlestick pattern.

- The high is the highest price point of the candle at a particular time.

- It’s still a green candle if the price is closed above the opening price.

- You will realize that the candlestick pattern will look like the hammer over here.

- The rising three methods pattern appears during an uptrend and is the opposite of the falling three methods pattern.

- Ultimately, this cheat sheet will help identify a candlestick pattern, especially at the beginning of your currency trading journey.

The hanging man pattern is a pattern that hints at a potential bearish reversal back lower. This pattern shows that the bulls have moved into the market and are looking to push prices back higher. This pattern has a long bullish body with little to no wicks on either side of the candle. Traders using this pattern will typically take a long position after it has confirmed itself, with the last candlestick closing higher. An example of this would be using popular indicators such as moving averages or the MACD. Using other indicators and price action analysis will help you confirm high-probability trades and increase your chance of winning trades.

What Are Some Common Candlestick Patterns?

Some of the more popular ones include the hammer, engulfing pattern, spinning top, piercing line, and doji star. Of course, some are easier to identify, while some are more complex. Those that are more complex are advanced chart patterns, and they are, as expected, more difficult to be recognized on charts. The only thing a beginner trader needs at the beginning of a trading journey is to survive the first few months and learn as much as possible. The first candlestick is bullish, and the second is a bearish candlestick.

We recommend that you seek independent financial advice and ensure you fully understand the risks involved before trading. Pick a day, pick a pattern, pull up the scanner, and take notes every time you see the pattern play out well. The understanding is that the amount of effort to push the stock to new highs is increasing. As you can see from the chart, often times vwap can be a great target area (red line).

Falling Window

The second candlestick is a small bullish candlestick that is entirely formed inside the first candlestick. Candlesticks and patterns https://g-markets.net/helpful-articles/complete-forex-trading-for-beginners-guide/ are the name of the game in trading. It doesn’t matter whether you’re new or a seasoned trader, we all have to learn them.

By the way, if you easily get tired of staring at Forex charts, what you need is this chart overlay indicator that gives your MT4 a fresh, modern look. The indicator also makes your chart look more compact and easier to analyze. If you aren’t fast enough to enter on the close of the Hanging Man and risk to the highs, it does offer a right shoulder for entry later. Ideally the next candle after the close of the Hanging Man would provide the nearest risk/reward entry at the top.

There are plenty of different types of chart patterns to help analyse the markets, but you are here to learn about the candlestick patterns – so let’s focus on that. The second is another sizeable bearish candle that gapped down. The third candlestick is a bullish candle that closes that last gap created. The Tweezer Bottom bullish candlestick pattern consists of two candles– usually with small bodies. The first should be a red/bearish candle, the second a green/bullish candle. All these candlestick patterns have been there long before the MT4 trading platform made its way into our lives.

The Doji forms when the market is undecided whether to go up or down. In the end, what forms is a candlestick with a small body and short wicks above and below the body. BA provides us with another look at this bearish candlestick pattern in a different context.

Advanced Cheat Sheet Candlestick Patterns Download (PDF File)

The closing price of this second candle, which is here, the closing price will be the closing price of the hammer. One thing you would notice is that the price close near the highs of the range. The lowest price point within the day the price traded is called the lows.

We encourage you to use our cheat sheets and download our Candlesticks eBook. With the right tools at your fingertips, you can become an effective trader. That’s how we combined candlestick patterns to make sense out of something that you are not quite sure of.

It consists of three candlesticks that all close lower than the previous candle. This candlestick chart pattern implies strong downside momentum and can be used alongside other technical indicators. A dark cloud is a bearish reversal chart pattern consisting of two candlesticks. Single candlestick patterns are the most common type of pattern, making up most of the candlestick patterns we see on our charts. These patterns always consist of a single candle and can signal a reversal, continuation, or indecision between the bulls and bears. Bullish candlesticks indicate that buyers are in control and that prices are likely to continue moving up.